Introduction to Business Tax Identification

A business registration number vs EIN comparison is one of the most important topics for new entrepreneurs to understand. These two identifiers may sound similar, but they serve very different purposes in the world of commerce. A business registration number is issued by the state to prove that a company is legally formed and authorized to operate, while an EIN or employer identification number is provided by the IRS for tax reporting and payroll responsibilities. Both numbers are essential for compliance, financial transparency, and credibility. Knowing the difference between them helps businesses avoid mistakes, secure licenses, open bank accounts, and build long-term trust with clients and partners.

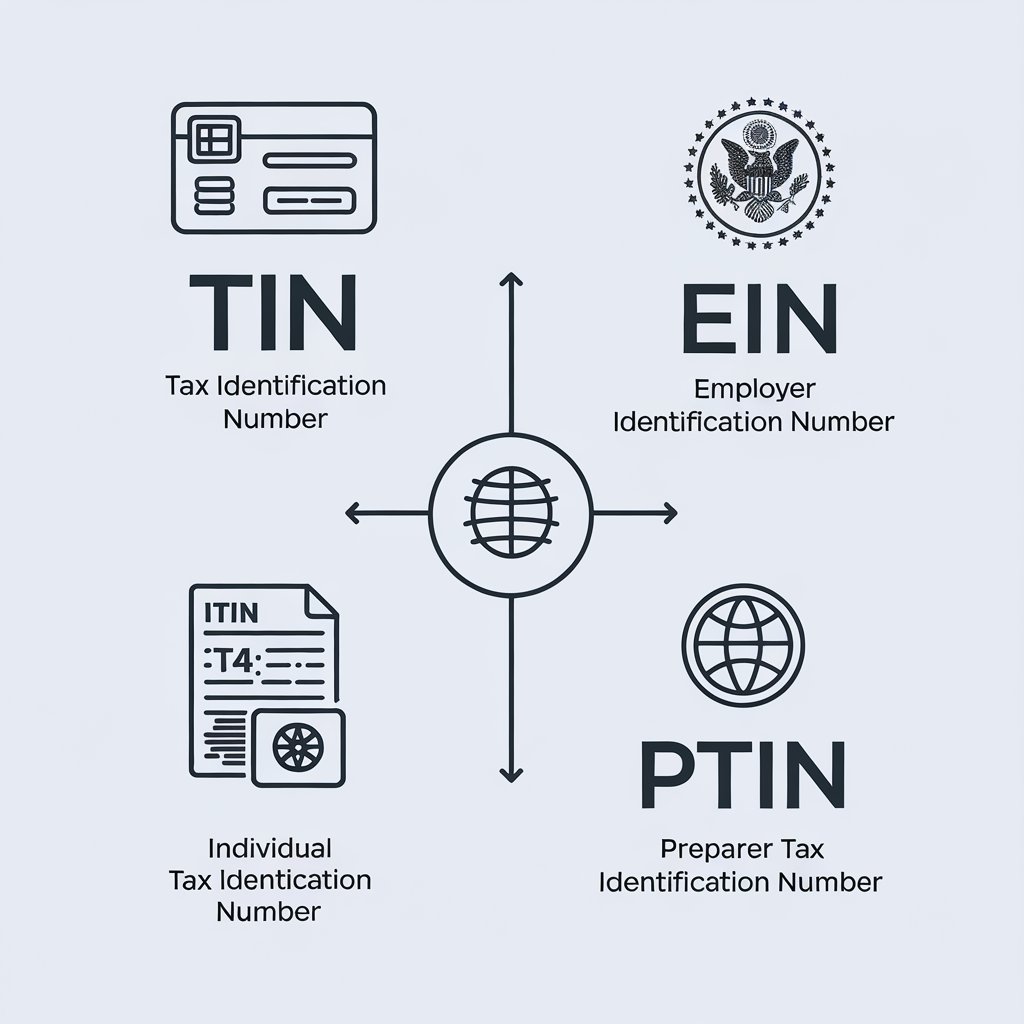

Understanding the Different Types of Tax ID Numbers

There are several types of business tax identification number. A TIN or taxpayer identification number is a broad term that covers many IDs. An EIN application process gives businesses an employer identification number for tax filing and payroll. An ITIN or individual taxpayer identification number is given to non-residents for tax purposes. A PTIN is used by tax professionals when filing on behalf of others.

Each ID has a specific role. For example, a company with employees must have an EIN vs company registration number difference because one is for tax reporting while the other is for legal formation. A company incorporation USA process may require both state and federal numbers. The IRS uses these IDs to monitor tax records, while states use registration numbers to check licensing and permits.

Business Registration Number vs. EIN: Key Differences

A company registration number meaning is linked to the formation of a business. It is issued by the state where the business is registered. It proves that the company exists as a legal entity. On the other hand, an IRS tax ID number or EIN is required for paying employees, filing federal taxes, and opening bank accounts.

The difference lies in purpose. A company registration requirements process is about legal structure while an EIN is about federal tax compliance. For example, a small retail store may have a registration number issued by its state and must also get an EIN for payroll and IRS purposes. Together they show both legal existence and tax identity.

Do All Businesses Need an EIN or Registration Number?

Not all businesses need both. Sole proprietors sometimes do not need an EIN if they have no employees, and they can use their Social Security number instead. However, as soon as they hire staff or want to separate personal and business finances, an EIN becomes necessary.

Every registered company must have a state business registration. Even partnerships and corporations are required to obtain a company formation documents package that includes a registration number. Without one, they cannot sign contracts, apply for permits, or expand internationally.

How to Obtain a Business Tax ID (TIN, EIN, or Registration Number)

The process is simple and fast. To apply for an EIN, businesses can use the IRS online portal. The EIN application process is free, and most companies receive their number instantly. For a registration number, companies must file with their state’s Secretary of State office. This often involves submitting business entity registration number applications and paying filing fees.

Here is a table that shows how IDs are obtained:

| Type of ID | Issuing Authority | Purpose | Timeframe |

|---|---|---|---|

| EIN | IRS | Federal tax reporting, payroll | Immediate (online) |

| Registration Number | State authority | Legal identity, contracts | Few days to weeks |

| ITIN | IRS | Non-resident tax reporting | 6–8 weeks |

| PTIN | IRS | Tax preparer identification | Immediate |

Finding and Verifying Your Business Registration Number

Finding a registration number is easy. It is usually printed on the certificate of incorporation or state approval documents. Many states provide online portals where you can search by company name and confirm details. This is useful for proving that a company is officially recognized.

To verify an EIN, businesses can check with the IRS. Banks and suppliers often request verification before signing agreements. This ensures that the business has a valid business tax identification number and is safe to work with.

Importance of State Registration and Business Permits

A federal EIN alone is not enough to run a business. States require their own forms of business permits and licenses for different industries. For example, a restaurant needs both a registration number and permits for food handling and alcohol service. Without state approval, the business cannot operate legally.

State registration also protects the business name. Once the registration is complete, no other company in that state can use the same name. This helps build a brand identity and keeps operations safe from legal disputes.

Tax and Compliance Implications of Missing IDs

The risks of not having a valid ID are serious. A business without an EIN cannot file taxes correctly and may face IRS penalties. Banks will reject account applications, and suppliers may refuse contracts. The IRS enforces strict tax and compliance services rules, so missing numbers create long-term problems.

In some cases, businesses are fined thousands of dollars for operating without registration. State governments also shut down companies that do not follow proper rules. This makes it clear that both an EIN and registration number are essential.

EIN & Registration Numbers Together: Your Business Compliance Duo

The real strength comes when businesses have both numbers. The dynamic duo of EIN and registration number ensures full compliance at both federal and state levels. Together they help with contracts, taxes, employee payroll, and banking.

For international business registration, having both is even more important. Global partners will always ask for a valid EIN and registration certificate before signing deals. This creates trust and shows that the company is reliable.

FAQ: Common Questions on EIN, TIN, and Registration Numbers

What is your business registration number in the USA?

In the USA, a business registration number is the state-issued number proving your company is legally registered.

Is EIN the same as VAT number?

No, an EIN is for U.S. tax reporting, while VAT numbers are used in countries with value-added tax systems.

What is the difference between EIN and company identification number?

An EIN is issued by the IRS for federal tax purposes, while a company identification number is given by the state for legal registration.

What is your business registration number in the USA?

It’s the unique number assigned by your state when you register your business.

Expert Guidance: Simplify Your Business Tax Compliance

Managing IDs can be difficult for new companies. Professional accounting & bookkeeping services help keep everything in order. A fractional CFO service can guide businesses through complex tax filing and compliance steps.

The smartest businesses invest in financial planning & analysis along with tax and compliance services to avoid mistakes. With expert help, companies can focus on growth instead of worrying about penalties or IRS issues.